travelling allowance subject to epf

Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third Schedule. Monthly contributions are made up of the employees and employers share which is paid by the employer through various methods available to them.

Jasmeen Is Working At Regal Haven Sdn Bhd With A Monthly Basic Course Hero

Other incidental allowances which are related to traveling such as transport allowance outstation allowance food allowance car allowance handphone allowance are subject to EPF contributions UNLESS the said payments are reimbursement in nature.

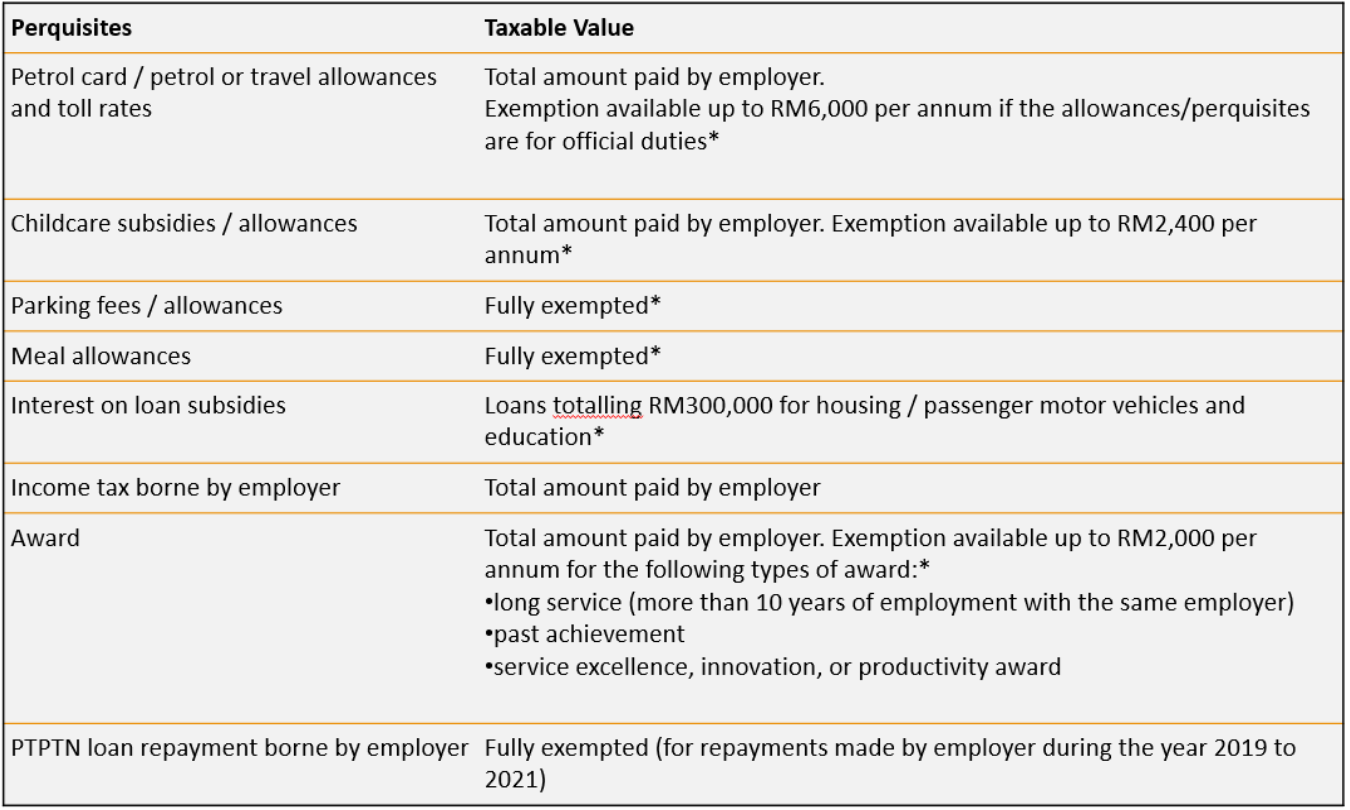

. Payments by an employer to any statutory fund for employees ii. Only applicable for YA 2009 to 2010 Travelling allowance petrol cards petrol allowance or toll. Rest days and public holidays Reimbursement for travel from homeoffice to the place of assignment not the normal place of work.

Any travelling allowance or the value of any travelling concession. For more information kindly refer to this page. Employees Provident Fund EPF contribution.

While the act specifies that allowances are subject to EPF it also specifies an overruling criteria whereby any travelling allowance or the value of any travelling concession are not subject to EPF. Additionally the following list of payments must be included when calculating EPF contributions for employees in Malaysia. Of EPF and Socso allowance Author.

However as the word is broad enough to include payments for food clothes accommodation phone calls etc reference can be had to case law to ascertain its scope. Allowances subjected to Socso deductions would include allowances payable by an employer to the employee but excludes travelling allowances or the value of any travelling concession and any sum paid to an employee to defray special expenses incurred as a result of his employment. The saving is comprised of the employees.

Bonus and Director Fee. Payment in lieu of notice of termination of service payment given when employees service is terminated Directors fee. All payments made to an employee paid at an hourly rate daily rate weekly rate piece or task rate is considered as wages.

SUBJECT EXEMPTION LIMIT PER YEAR 1. Any sum paid to cover expenses incurred by the employee in. If the amount received exceeds RM6000 a year the employee can make a further deduction in respect of.

The payments below are not considered wages by the EPF and are not subject to EPF deduction. The general terms for remittance of Retirement Benefits to the EPF are. Mileage claims and traveling allowance.

Any other remuneration or payments as may be exempted by the Minister. Allowances such as incentives shift food meal cost of living housing and etc. For example employee A earns RM6000 per month as their basic salary.

RPFC went on appeal Surya Roshni Ltd. Any contribution payable by the employer towards any pension or provident fund. Purpose of calculating provident fund contribution.

Section 131a Allowances Fixed allowance are taxable income except for the following- Exempted allowance From YA 2009 a travel allowance of RM2400 per year would be exempted for travelling between home and work. Payments Exempted From EPF Contribution. Petrol allowance travelling allowance or toll payment or any of its combination for official duties.

The Employees Provident Fund EPF or commonly known as Kumpulan Wang Simpanan Pekerja KWSP is a social security institution formed according to the Laws of Malaysia Employees Provident Fund Act 1991 Act 452 which manages the compulsory savings plan and retirement planning for private sector workers in Malaysia. At current it is mandatory for employed Malaysian citizens to contribute to the EPF. Allowance except travelling allowance is included in the definition of wages under the EPF Act.

Promotional gift of trading product Promotional samples Gift with company logo Printing and stationery Travelling allowance to employees Travelling for carrying on a business Petrol or mileage claims by employees. Employers need to obtain consent from employees in accordance with the provisions of Section 44 of the EPF Act before the transfer of Retirement Benefits. In general all monetary payments that are meant to be wages are subject to EPF contribution.

Any gratuity payable on discharge or retirement of the employee. Reimbursement for travel in the line of official duty Reimbursement for travel between home and workplace beyond normal working hours eg. Gratuity or payment for dismissalretrenchment.

For the month of September they receive a bonus of RM250 as. The payments below are not considered wages and are not included in the calculations for monthly deductions. Employees Provident Fund and others Madhya Pradesh High Court Whether Transport.

Gratuity payment to employee payable at the end of a service period or upon voluntary resignation Gifts includes Cash Payments for holidays like Hari Raya Christmas etc. Governed under the Employee Provident Fund Act 1991 EPF is a retirement saving scheme for employees who are liable to contribute EPF in Malaysia in which the savings contributed will be managed and invested under Simpanan Konvensional or Simpanan Shariah. Updated May 6 2020.

Payments Subject to EPF Contribution. In short yes bonuses and cash allowances are considered to be part of your wages. However the following payments are not considered as wages.

Such a transfer can be made through Form KWSP 16F by individual or group. Foreigners working in Malaysia are not obligated to contribute to EPF but may opt. As the scenario mentioned by the original author is mainly relating to Transport these would not be taken into account for EPF.

Any other remuneration or payment as may be exempted by the Minister. Courts will consider factors such as whether the allowances are a fixed sum. Among the payments that are exempted from EIS contribution include.

New Straits Times Subject. Retrenchment lay-off or termination benefits. Allowance except travelling allowance is included in the definition of wages under the EPF Act.

However as the word is broad enough to include payments for food clothes accommodation phone calls etc reference can be had to case law to ascertain its scope. Allowance EPF SOCSO Business insurance Rental of premises. Please refer to this page for more details.

Membership of the EPF is mandatory for. Special allowance was not linked to the consumer price index and not in the nature of dearness allowance and hence did not fall within the definition of basic wage. Payments which are not liable for EPF contribution are-.

Any travelling allowances or the value of any travelling concession.

Production Of Receipt Vouchers For Reimbursement Of Travelling Charges For Travel Within The City Admissible Under Daily Allowance On Tour Circular No 152 Central Government Staff Rules Circulars And Orders Govt Staff

Jasmeen Is Working At Regal Haven Sdn Bhd With A Monthly Basic Course Hero

Msia Hr News Just Another Wordpress Com Site

Jasmeen Is Working At Regal Haven Sdn Bhd With A Monthly Basic Course Hero

Clarification Regarding Travelling Allowance Ta Rules After The Implementation Of 7th Cpc 7thcpc Travellingallowance Ta Http Cent Allowance Rules Travel

Everything You Need To Know About Running Payroll In Malaysia

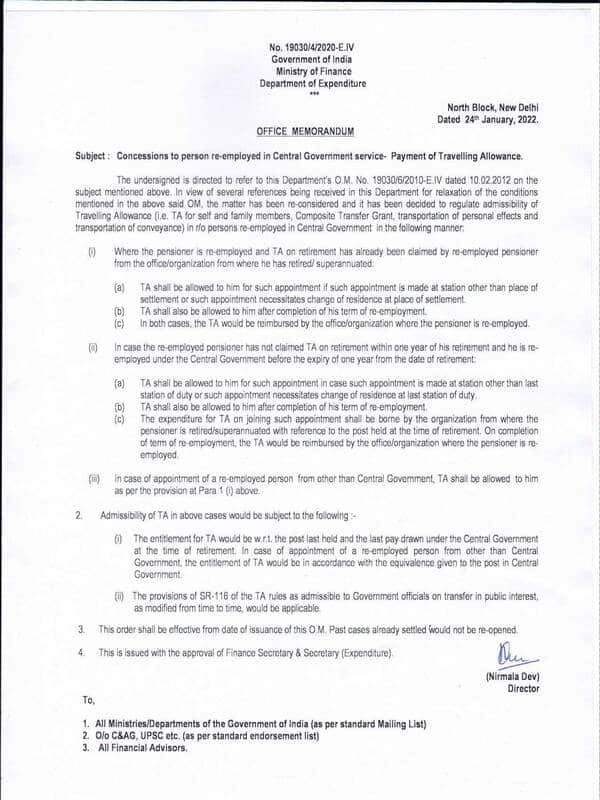

Travelling Allowance Concessions To Person Re Employed In Central Government Service Doe Om Dated 24 01 2022 Central Government Staff Rules Circulars And Orders Govt Staff

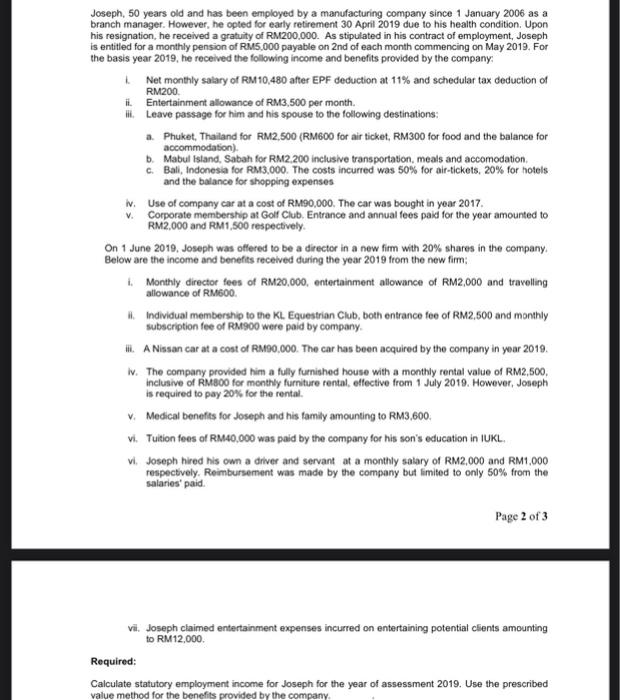

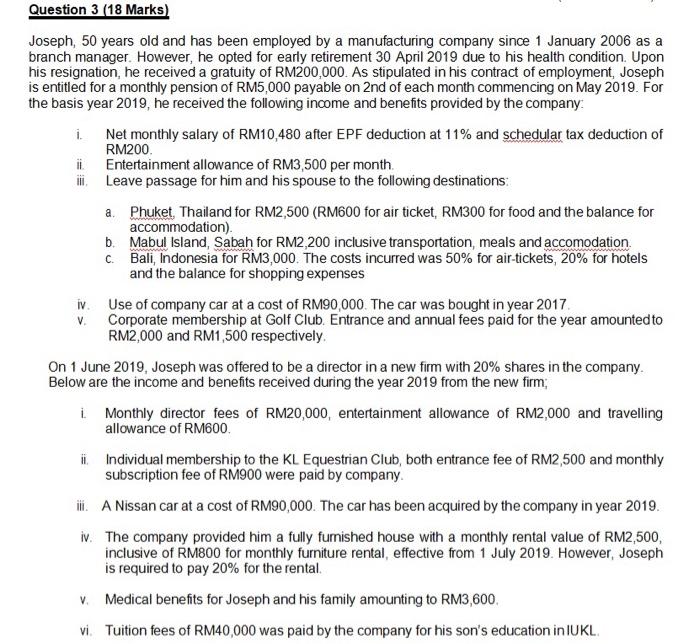

Solved V Joseph 50 Years Old And Has Been Employed By A Chegg Com

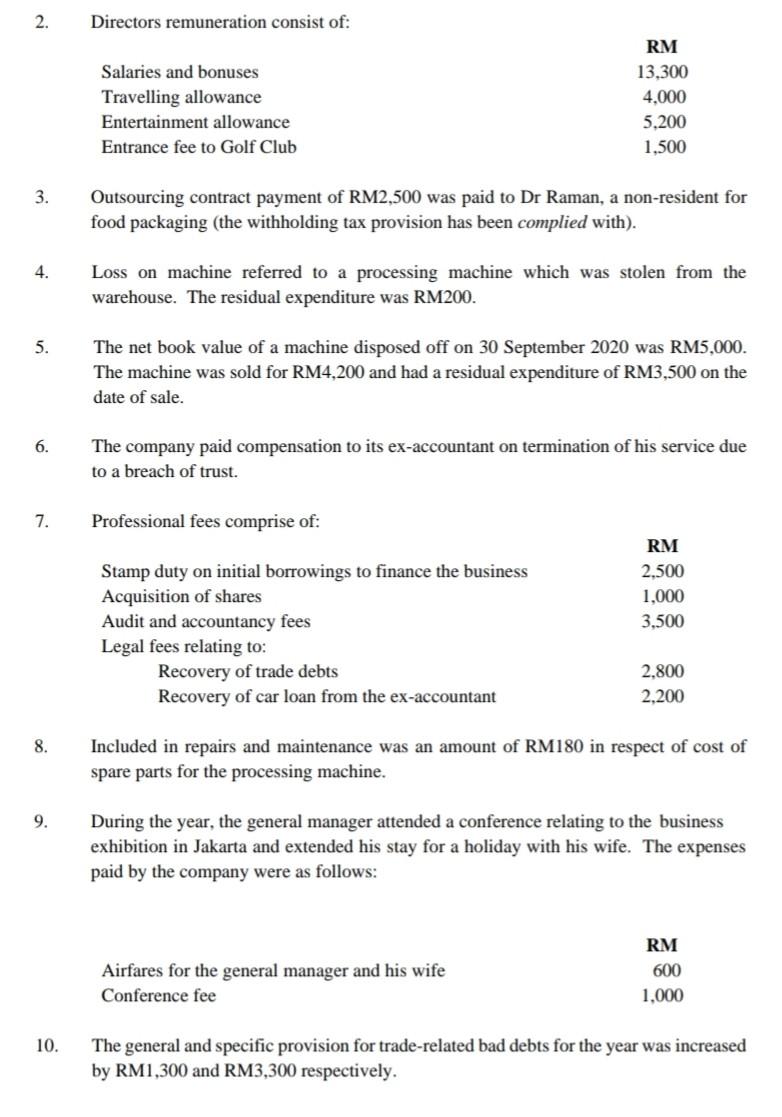

Corono Enterprise A Manufacturer That Produces Chegg Com

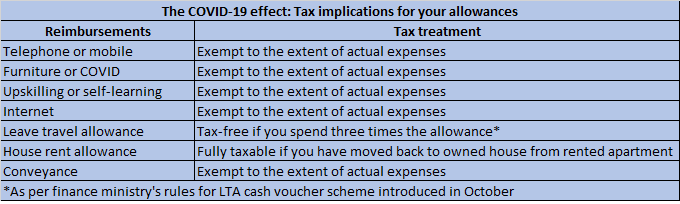

Work From Home Here Is How Reimbursements And Allowances Will Be Taxed

Leave Travel Allowance Lta Claim Rule Eligibility Tax Exemptions

Payment Of Ota And Ta To Railway Employees By 50 Measures To Reduce Costs And Improve Savings Reduce Cost Ota Cost

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Employee Provident Fund 2 Social Security Organization 3 Inland Revenue Board Of Skachat Besplatno I Bez Registracii

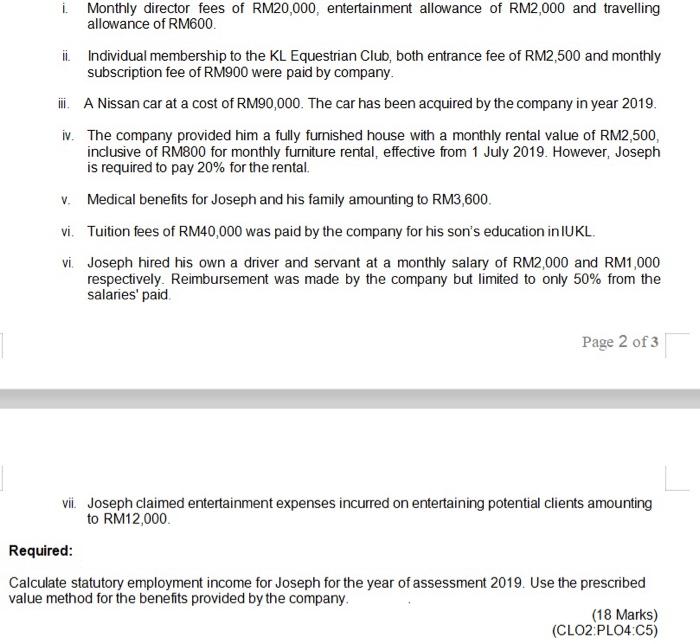

Solved Hii Question 3 18 Marks Joseph 50 Years Old And Chegg Com

Jasmeen Is Working At Regal Haven Sdn Bhd With A Monthly Basic Course Hero

Jasmeen Is Working At Regal Haven Sdn Bhd With A Monthly Basic Course Hero

Solved Hii Question 3 18 Marks Joseph 50 Years Old And Chegg Com

Travelling Allowance Rules Production Of Receipts Vouchers For Reimbursement Of Travelling Charges Deptt Of Post Allowance Communication Department Receipts

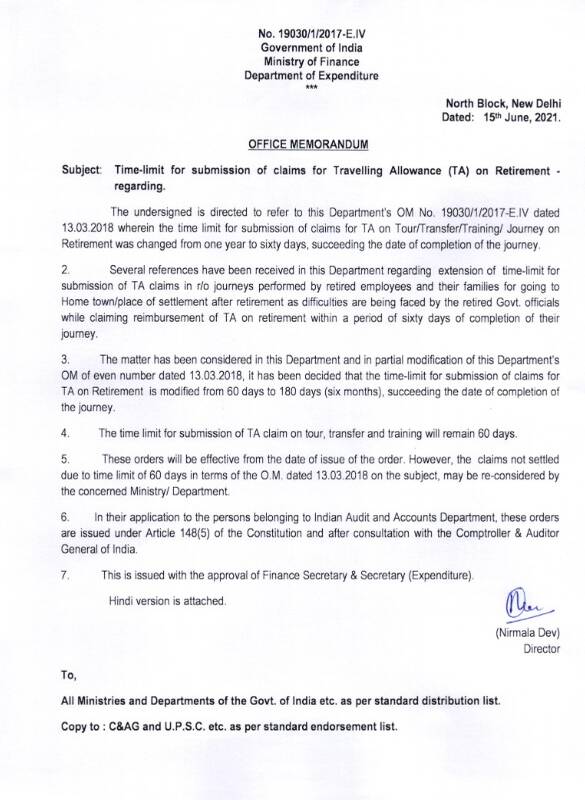

6 Months 180 Days Time Limit For Submission Of Retirement Ta Claims Fin Min Om No 19030 1 2017 E Iv Dated 15 06 2021 Central Government Staff Rules Circulars And Orders Govt Staff

No comments for "travelling allowance subject to epf"

Post a Comment